In 2021, Dartmouth formally announced its intention to fully divest the endowment from fossil fuel companies. The decision followed years of student activism and placed the College among Brown University, Cornell University, Columbia University and Harvard University in making similar commitments. These universities are hardly alone in the divestment trend. According to the pro-divestment Global Fossil Fuel Divestment Commitment Database, nearly 1,600 institutions with combined assets over $40 trillion have committed to fully or partially divest from fossil fuels.

Upon first consideration, the decision to divest from the fossil fuel industry seems intuitive. Fossil fuel combustion is a primary contributor to the greenhouse gas emissions that are driving global climate change, and advocates suggest that divestment will stigmatize the fossil fuel industry, remove its access to capital and eventually lead to its demise: Climate crisis solved — or at least defunded. However, there is little evidence that fossil fuel divestment actually accomplishes emissions reductions, and the practice might even increase emissions. Indeed, fossil fuel companies have a critical role to play in developing climate tools, such as cleaner fuels and carbon capture. Instead of indiscriminate disinvestment from fossil fuel holdings, Dartmouth should use its financial power to partner with the fossil fuel industry to both meet current needs and innovate clean energy solutions.

First, Dartmouth’s and other institutions’ divestment strategies are not obviously effective in accomplishing real mitigation results: Reducing emissions. They might even encourage more greenhouse gas emissions. As Tom Johansmeyer points out in the Harvard Business Review, simply selling fossil fuel assets does not necessarily encourage the operation to decrease production. Faced with a decreased asset value, new shareholders are incentivized to increase fossil fuel production, often increasing emissions. Rather, Johansmeyer suggests that “run-off,” or allowing assets to expire, is a more effective divestment strategy. While Dartmouth plans to run-off its remaining fossil fuel assets, even this strategy could encourage more emissions. As Queen’s University Belfast scholar Stefan Andreasson argues, decreasing the market share of Western-based international oil companies would give more power to state-owned oil companies to increase production. Because state-owned oil companies have little to no shareholder pressure and very opaque operations, they generally produce dirtier fossil fuels. Divestment does not address fossil fuel demand — which is expected to continue rising over the next 10 years — it simply cedes shareholder and market power to less climate-conscious interests.

Climate mitigation strategies should primarily focus on reducing emissions, not crippling fossil fuel producers. While burning energy-dense hydrocarbons like coal, natural gas and oil is the primary source of human-caused greenhouse gas emissions in the United States, innovations from the fossil fuel industry have been critical in reducing national carbon dioxide emissions. For instance, the nearly 36% decline in American carbon dioxide emissions from 2005-2021 was in part due to cheap natural gas displacing coal. While recent research suggests that methane leaks could make the greenhouse gas intensity of natural gas comparable to higher-carbon fuels, companies have market incentives to use quickly-developing technology to mitigate their product’s leakage. Public policy and selective investment in companies that are taking on this challenge would bolster cleaner fuels.

Further, oil and gas companies are developing the only at-scale carbon sequestration techniques on the market. Using enhanced oil recovery, 300-600 kilograms of carbon dioxide are sequestered per barrel of oil. In transportation and combustion, each barrel will produce about 500 kg of carbon dioxide, creating carbon-neutral oil, provided that the sequestered carbon dioxide would have been otherwise emitted. While about 70% of the carbon dioxide used in this process comes from naturally-occurring deposits, the Century and Petra Nova projects use carbon dioxide from human sources for enhanced oil recovery, demonstrating industrial-source carbon sequestration at scale. Other carbon capture technologies are being rapidly developed, too. Domestic oil producer Continental Resources has invested hundreds of millions in a carbon capture project in North Dakota, where it will use its geologic expertise to sequester carbon dioxide from distant ethanol production sites. Players like Chevron, Shell, Occidental Petroleum and others are leading in developing direct air capture carbon sequestration technology. By investing in fossil fuel companies actively developing technologies like these, Dartmouth could both encourage and fund critical climate innovations.

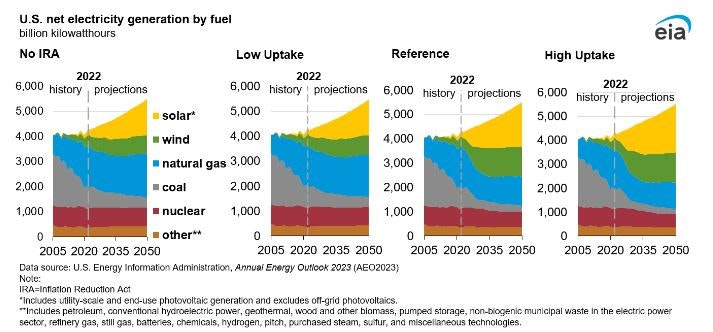

Real climate solutions involve clean energy technologies like nuclear, bioenergy, hydrogen, wind and solar to rapidly decrease greenhouse gas emissions. However, fossil fuels will also continue to play a role in meeting domestic and global energy needs, and we must have the tools to address resultant emissions. Even according to the U.S. Energy Information Administration’s most optimistic projection of the effects of the Inflation Reduction Act, natural gas will still account for about 20% of U.S. electricity generation by 2050. Critically, this projection accounts for only a fraction of mid-century fossil fuel use. Electricity generation is one of the easiest-to-decarbonize sectors, and the projection does not account for other domestic energy needs, much less global fossil fuel demand.

From the U.S. Energy Information Administration.

To even approach emission reduction goals, we must develop scalable technologies to effectively sequester carbon emissions. Even if the entire globe were to cease net greenhouse gas emissions by 2050, we would still need carbon sequestration technology to remove greenhouse gases already in the atmosphere. The major players taking steps to decrease emissions and developing the scalable capabilities to sequester greenhouse gas are the firms that know the geology best, have access to capital and are influenced by climate-conscious shareholders: The Western-based fossil fuel companies Dartmouth and other institutions are divesting from. Investing in forward-looking fossil fuel companies would allow Dartmouth to encourage climate-friendly innovations and practices critical for a sustainable future. In contrast, indiscriminate divestment might actually increase emissions. Like any other asset, Dartmouth should not blindly invest in fossil fuel companies. Rather, policy and private investment should be structured to support companies, fossil fuel or not, that meet current needs while developing realistic pathways to meet future needs.

Opinion articles represent the views of their author(s), which are not necessarily those of The Dartmouth.