On Nov. 20, a team of Dartmouth students won the 17th annual national College Fed Challenge for the first time in the College’s 10 years of participation in the competition. The competition, which is organized by the Federal Reserve, takes place in two parts: a 15-minute scripted presentation in which students role-play as members of the Fed’s Federal Open Market Committee and provide a monetary policy recommendation, and a question and answer session about their recommendation in front of a panel of judges, who are members of the Fed.

Dartmouth’s Fed Challenge team was advised by economics professors Elisabeth Curtis and Frank Zarnowski and consisted of the 12 students enrolled in ECON 78, “Fed Challenge:” Ayan Agarwal ’21, Tench Coxe ’21, Bill Cui '21, Utsav Jalan ’21, Kira Koehler ’21, Vitor Berganton de Souza '21, Autumn Dinh '21, Jimmy Nguyen '21, Zack Olson ’21, Michael St. George '21, Alice Zhang '21 and Alina Zhang '22.

Five of those students — Agarwal, Coxe, Jalan, Koehler and Olson — were voted by their peers to present for the team during the competition. In an interview with The Dartmouth, Agarwal, Coxe, Koehler and Olson discussed their experiences in the competition and their recommendations for how the Fed can help the economy recover from COVID-19.

This is the first time that Dartmouth has won the national Fed Challenge. How does it feel to be part of this historic win?

Tench Coxe: I was not expecting to win. It was just really thrilling.

Ayan Agarwal: Because the competition was virtual, the Federal Reserve added a lot of teams that usually don't compete. It was one of the more competitive years, which also made winning even more rewarding.

Kira Koehler: Hearing our name announced by Federal Reserve Board Chair Jerome Powell and the Fed team was the cherry on top of a really great term.

How would you explain your policy recommendations in layman’s terms? What are the implications?

TC: One of our large policy changes was to the Main Street Lending Program, which gives money to Main Street corporations — small- and medium-sized businesses — rather than Wall Street. The implication behind that is that the vast majority of businesses in the United States are small and medium businesses. Main Street corporations employ the most people, so if you can make sure that they don't close, you can save jobs and get money to people. They were left out of all these big bailouts. The program was not initially very successful. It's very hard to get money to them because of Fed regulations.

KK: Our other recommendations were keeping the interest rate between zero and a quarter percent and then continuing with the quantitative easing that the Fed is currently doing. Quantitative easing means increasing holdings of Treasury securities.

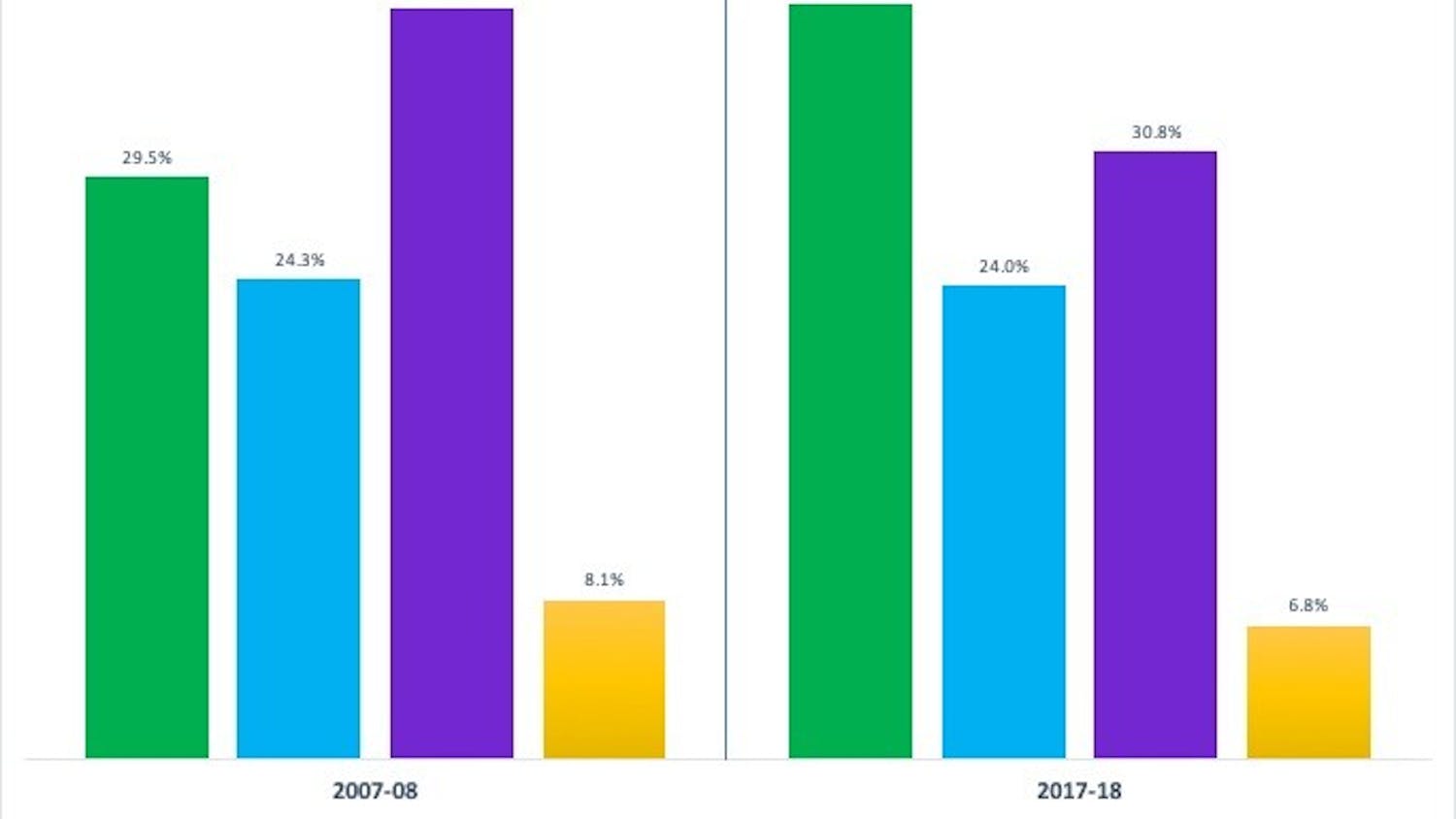

To make it relatable to the Dartmouth students, I would note that we are in an extremely deflationary environment right now, which means that prices are going down. Spending on things like health care and education has increased. The prices of tuition are up 1.3%, and health care is up 5%. This is relative to a lot of other prices decreasing.

In your presentation, you mentioned that it will take a while for the economy to recover after the COVID-19 pandemic. How do you think the Fed’s actions can impact the amount of time needed for the economy to recover?

AA: Assigning an amount of time to this is really a fool's errand. In the short and medium term, we expect that households and businesses are going to remain cautious. They'll likely increase their savings and reduce spending and hiring of capital investment. The real depth of this recession is going to leave scars. You're going to see business closures and the deterioration of the skills of unemployed workers.

KK: Depending on the course of the virus, some restructuring of the economy may be needed. People and resources will need to be redeployed out of sectors that have been most damaged by the pandemic. Business operations will need to be reorganized to protect workers and customers. All of that is going to take a lot of time and money.

TC: The Fed can't do anything to speed along the course of the virus. The only thing the Fed can really do is try to be as accommodating as possible to households and businesses to minimize the damage. When we do get rid of the virus, the Fed needs to again be accommodating so that businesses and households can recover as quickly as possible.

Zack Olson: When there are recessionary pressures like this, the financial markets generally are not very accommodating to people who are in need of funds. Interest rates usually rise, and people’s risk tolerances become lower. The Fed’s primary tool is to control interest rates. We saw this in March when they lowered short term interest rates to zero, which essentially makes credit cheaper to borrowers.

Do you think there is a limit to how the Fed can help during COVID-19? What fiscal policy changes would you hope to see to supplement your proposed monetary policies?

TC: The Fed can't do anything to make the economy grow. They can create room for growth with low interest rates and offering bailouts. But, you need underlying growth at the level of household and enterprise expenditures to actually grow the economy.

Most immediately and simply, a cash stimulus would be a great start. When you have a government that's telling people to shut down for safety, most people still have bills to pay. The job of fiscal policies is to get money to people.

AA: Congress needs to support state and local efforts to open businesses and schools. The most important thing in restoring economic growth is improving public health, and investments within that space are going to pay off many times over. Enhanced unemployment insurance should be extended, and programs like food stamps should also be adequately funded.

KK: Fiscal policy can help underrepresented labor markets, especially women, low-income households and minorities. Future government stimulus could include spending on education, transportation and social protection, which would help increase the jobs available in underrepresented markets. Local governments could borrow money by issuing bonds.

ECON 78, “Fed Challenge,” is a class offered every fall in the economics department. Why did you decide to take the class? What would you say to Dartmouth students who are considering taking it?

KK: I thought this would be a really great way to immerse myself in the practicality of implementing monetary policy. It was awesome getting to know a group of 11 other students closely and work with them on an academic competition.

Having a really comprehensive understanding of monetary policy and the role of the Fed is important in whatever direction you choose to take. It just gives you a broad picture of relevant ideas that influence your day-to-day life.

TC: Definitely take the class. It’s a unique opportunity to apply a lot of the economic principles that you've been learning about and to have a deeper insight into what the Fed is doing. Plus, it’s really fun.

It was definitely cool to see the Fed make changes that were in line with our thinking. There have been some revisions in the Main Street Lending Program, and the changes that we proposed are in line with those modifications.

ZO: It was the most practically relevant class that I’ve taken at Dartmouth. No other classes have given me this deep of an understanding of current events.

This interview has been edited and condensed for clarity and length.