Propelled by a 14.6 percent growth in investment gains, Dartmouth’s endowment has increased to $4.96 billion — the highest it has ever been, the College announced last month. For the fiscal year ending June 30, the College earned a total of $630 million in investment gains, in addition to $77 million in gifts and other transfers.

Chief financial officer Michael Wagner said that the positive endowment figures can be attributed to recent growth in global financial markets as well as strategies employed by the College’s investment office.

“The market itself has been on a great run, and we’re benefiting from that because of our investment allocation,” Wagner said.

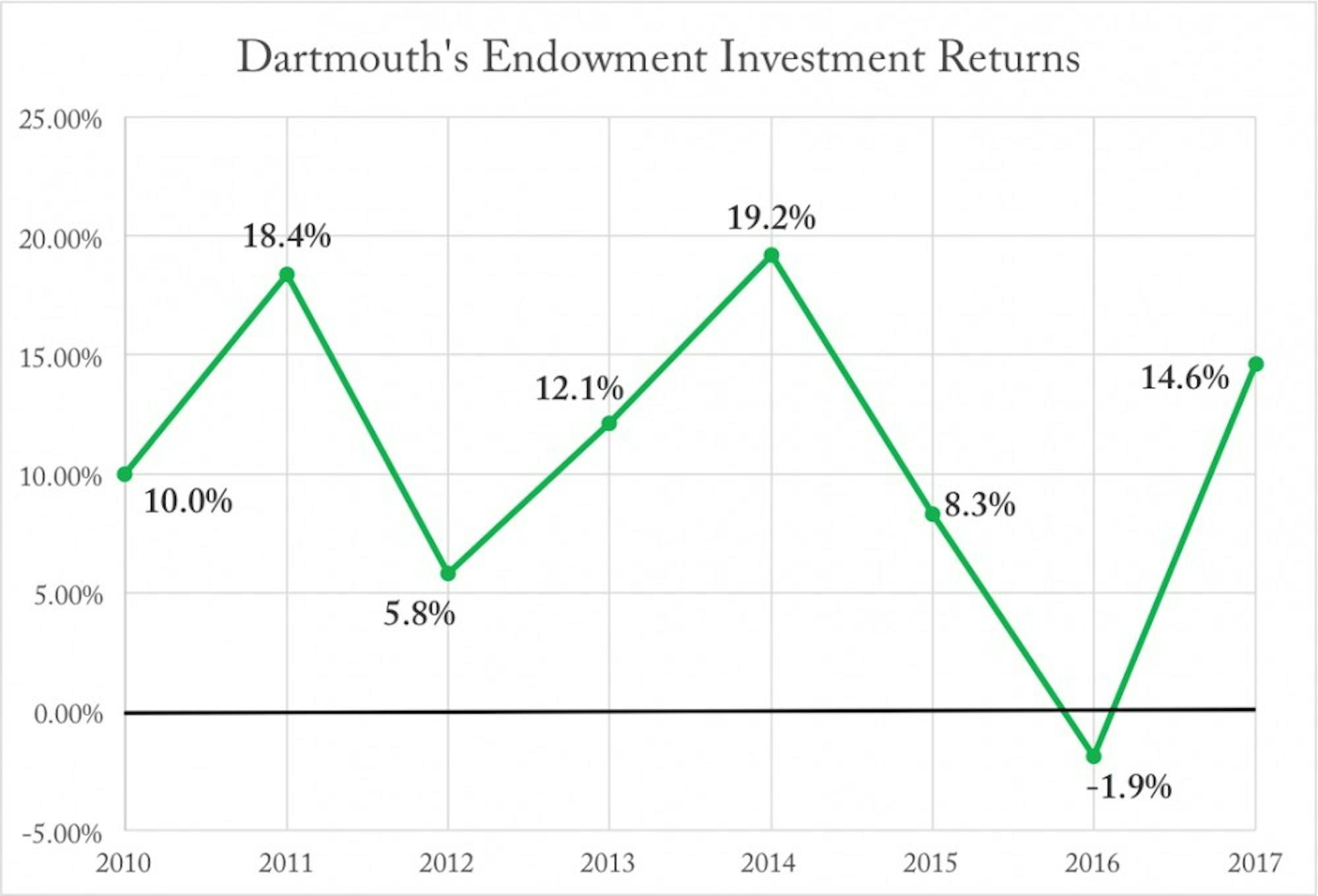

Wagner added that the College’s investment strategy did not change significantly since the 2016 fiscal year, in which the endowment saw a loss of 1.9 percent. He noted that Dartmouth’s spending distribution from the endowment last year of $225 million — around 25 percent of the College’s net operating revenue — is a relatively typical amount.

Executive vice president Rick Mills said that in the long run, the College aims for a 7 to 8 percent growth rate in the endowment, which would allow for a 5 percent distribution rate from the endowment, assuming 2 to 3 percent inflation.

“Having a distribution rate that, together with inflation, is equal to or less than the return rate gives you the ability to maintain the purchasing power of the endowment over the long turn,” Mills said. “But returns are highly volatile.”

Mills added that while it would be beneficial for Dartmouth to spend more from its endowment annually, which could decrease tuition or increase financial aid, the size of the endowment necessitates a combination of revenue sources, including tuition, research funding and endowment spending.

Wagner noted that Dartmouth is one of the top 50 schools in the country in terms of endowment per student. He added that the College lies in a middle ground between peer institutions like Princeton University that are more dependent on their endowments for revenue, and those like the Massachusetts Institute of Technology, which have more funding from research and are less dependent on their endowments.

Chair of the Board of Trustees’ investment committee Richard Kimball ’78 called the positive endowment returns “terrific,” adding that he thinks the investment strategy for the endowment is pointed in the right direction.

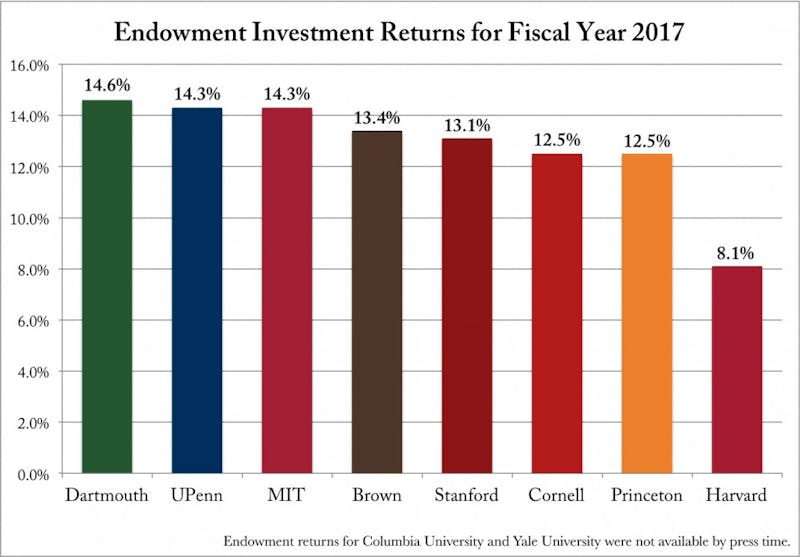

“Compared to returns we’ve seen from some of our Ivy League peers, I think our numbers look very good,” Kimball said.

Of the Ivy League institutions that have released their endowment returns for fiscal year 2017, the College has seen the highest gains. University of Pennsylvania, Brown University, Cornell University, Princeton University and Harvard University saw FY2017 returns of 14.3 percent, 13.4 percent, 12.5 percent, 12.5 percent and 8.1 percent respectively.

Like Wagner, Kimball said that the College’s investment strategy did not change significantly since last year, but he noted that the College is trying to be more disciplined in finding the best possible money managers for the endowment while leaving under performing managers.

“It’s pretty simple,” Kimball said. “If you find managers that … are consistently outperforming [the market], you probably want to give them money.”

In an email statement, economics professor Bruce Sacerdote said that the College’s investment office has been able to find the best money managers, and that the College has positioned itself as a desirable long-term partner.

“Dartmouth does well by allocating to sectors that have high returns and by finding great managers within each sector,” Sacerdote wrote. “Dartmouth has a very long-run mentality which enables the investment office to allocate money to illiquid, but high returning, investments in private equity, venture capital, energy and real estate. Dartmouth also has a lot of the portfolio in public equities which does require a long-term mentality since the year-to-year fluctuations are sometimes painful.”

Sacerdote added that a larger endowment allows the College to spend more on financial aid, faculty hiring, research, student support services and athletics, among other fields.

Wagner said that the recently-reported endowment returns will not affect the current FY2018 budget, which was planned before the return statistic figure was calculated. He added, however, that the news will probably have a positive impact on the FY2019 budget.

In three of the last four years, the College reported net shortfalls in the budget, including a $112 million loss last year.

Mills noted that Dartmouth has roughly $450 million in cash and operating reserves separate from the endowment that also saw positive returns, but did not specify to what extent.

Kimball said that a growing endowment is especially important to students considering that full cost of educating a Dartmouth student is approximately twice the price charged to a full-paying student; therefore, he noted, the endowment allows the College to essentially offer its product at a 50 percent discount.

“[The endowment] over the long term has a significant impact on the quality of education,” Kimball said. “And we’re fortunate at Dartmouth to have a fairly large endowment for an institution of our size.”